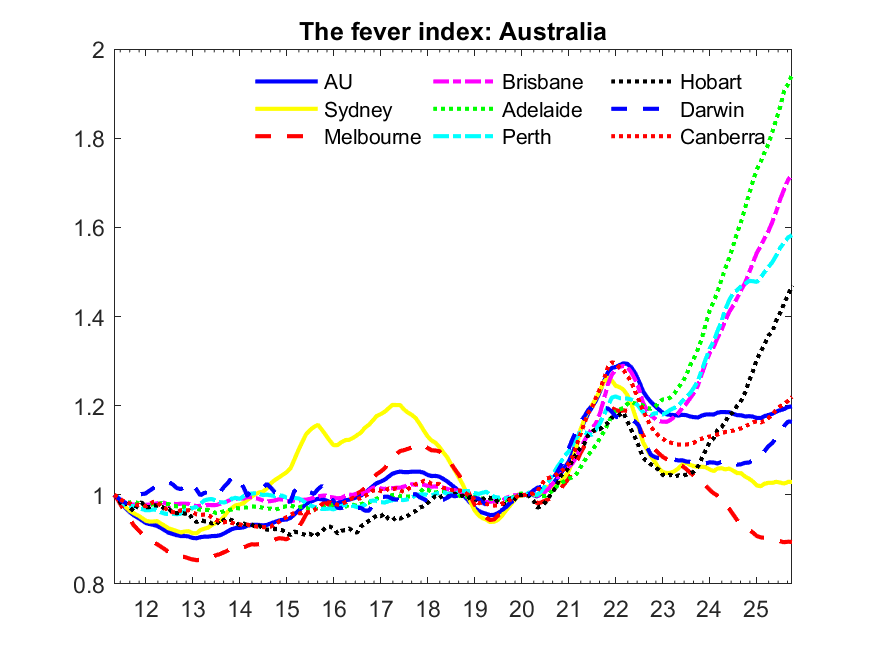

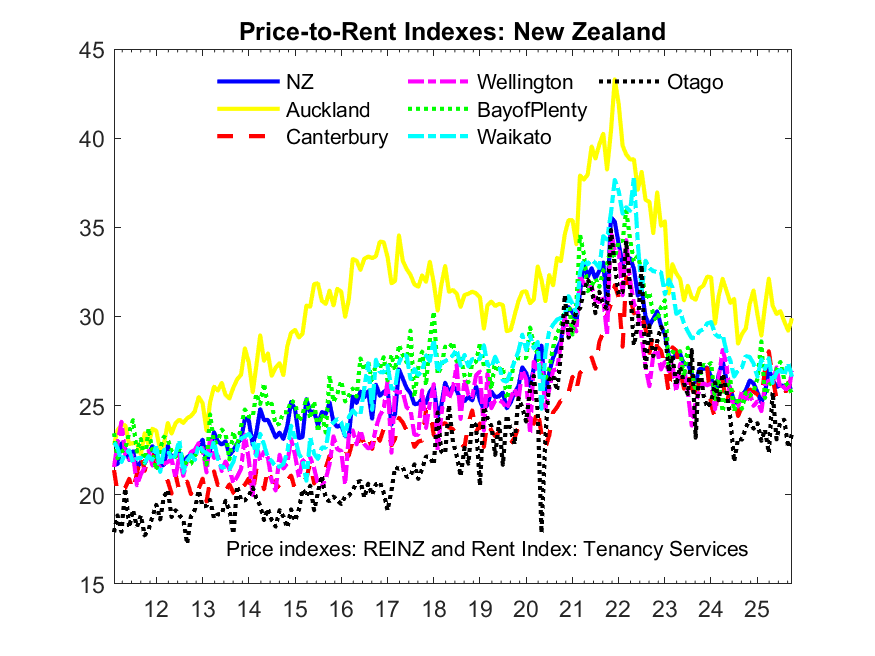

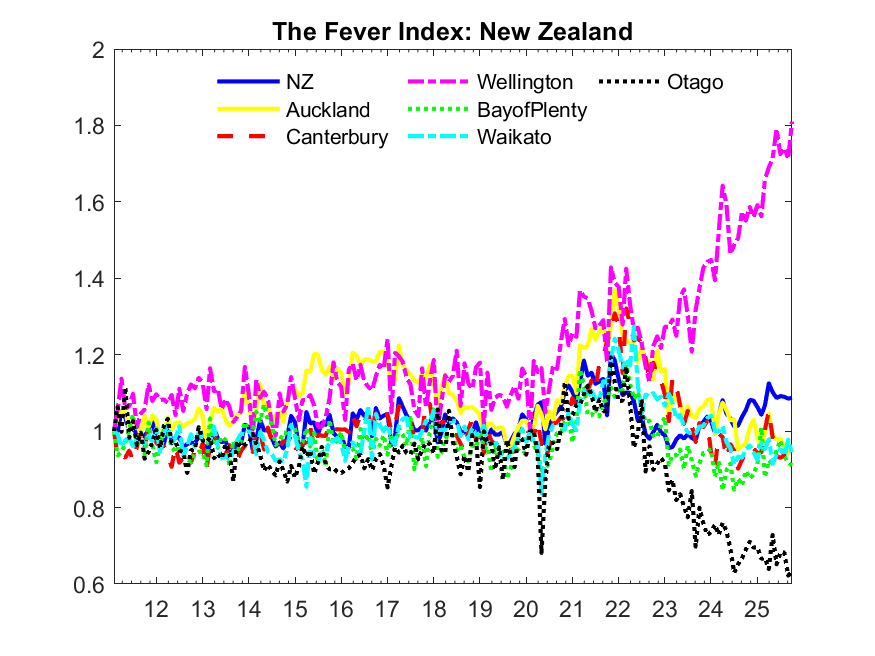

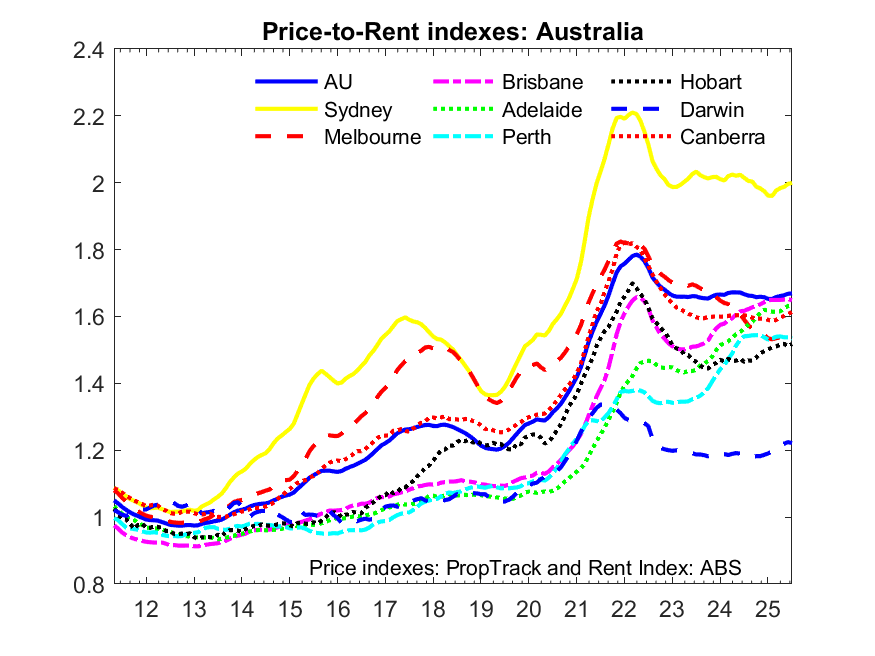

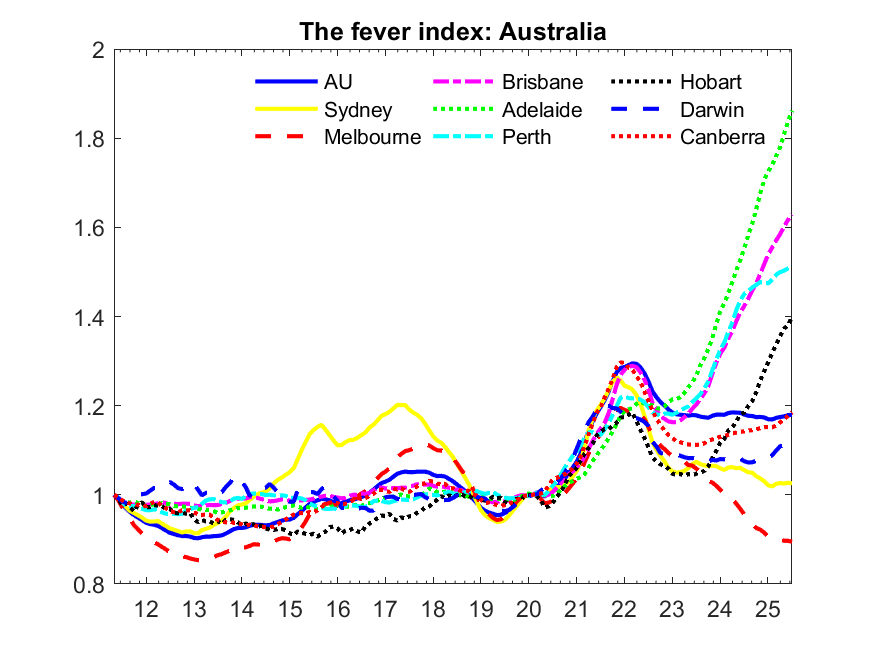

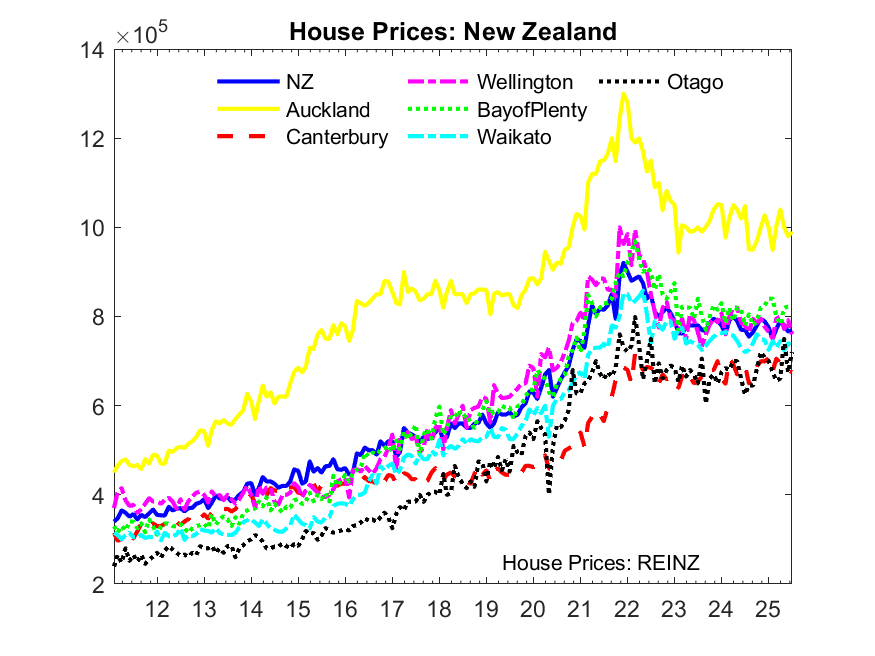

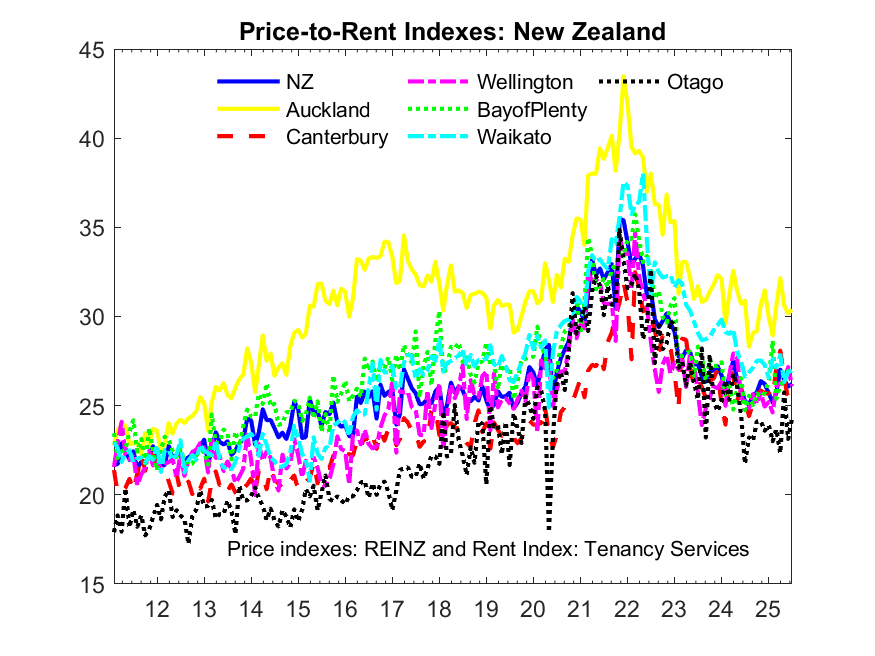

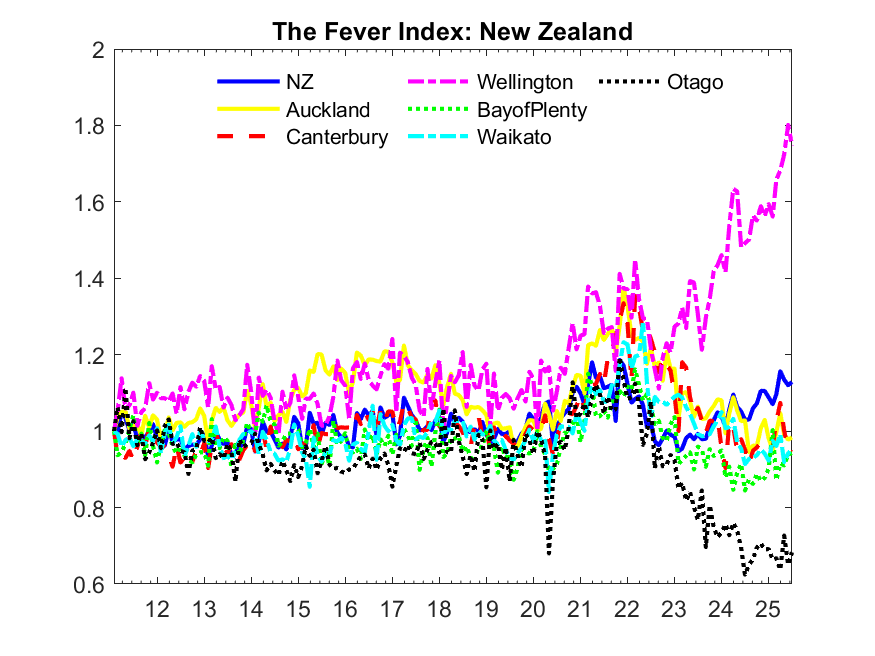

This website provides real-time bubble indicators for housing markets in the eight Australian capital cities and primary New Zealand regions. These indicators provide a direct quantitative measure of the extent of housing fever in these major metropolitan areas. The measures are benchmarked against housing and macroeconomic fundamentals so that they provide a statistical mechanism for assessing the existence and the degree of speculative behaviour in these housing markets.

The markets considered are as follows.

- Australia: Sydney, Melbourne, Brisbane, Adelaide, Perth, Hobart, Darwin, and Canberra

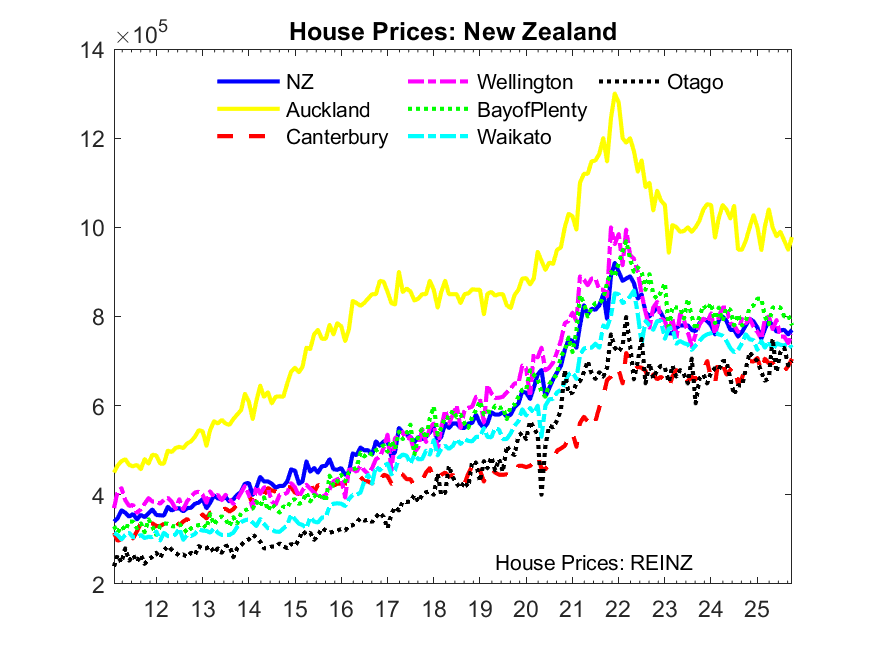

- New Zealand: Auckland, Canterbury, Wellington, Bay of Plenty, Waikato, and Otago

September 2025

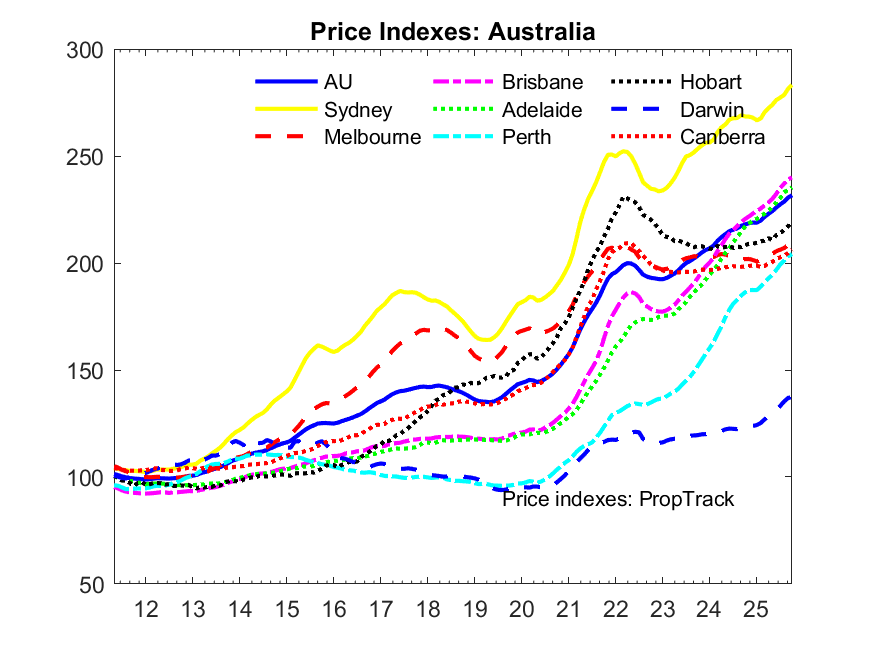

Australia The Australian housing market maintained upward momentum into mid-2025, though regional patterns diverged. Sydney and Darwin prices have resumed growth after a short period of consolidation, while Perth, Adelaide, and Brisbane continue to accelerate more sharply. Hobart remains below its 2022 peak, showing a gradual recovery, and Melbourne remains largely flat. Overall, national prices

June 2025

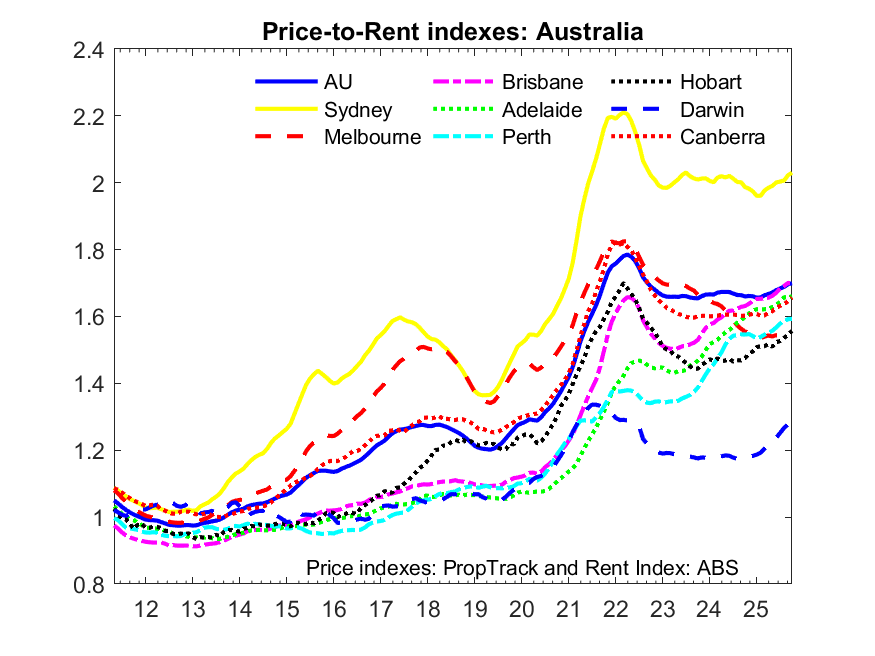

The Australian housing market showed modest divergence in early 2025. Sydney, Brisbane, Adelaide, and Perth maintained clear upward momentum, while Hobart, Canberra, Melbourne and Darwin remained largely flat. Price-to-rent ratios remained broadly flat across all capital cities, indicating that rents and prices have moved in tandem. The fever index, however, reveals evidence of some uneven

March 2025

The Australian housing market showed signs of stabilization and broad-based cooling in the first quarter of 2025. Adelaide, Brisbane, and Perth—previously strong performers—now exhibited signs of slowing momentum, with growth easing across these cities. In contrast, Sydney, Melbourne, Canberra, Hobart, and Darwin saw flat or mildly corrected house prices, continuing their subdued trends from late

This project is supported by the Australian Research Council under Project No. DP190102049.